When Are 1099-Nec Due 2024. If the deadline falls on any weekend or public holiday, the deadline will move to the next business day. What is the business process for form 1099 rules compliance for 2023?

Copy a must be filed (paper or electronic version) with the irs, and copy b must be sent to the contractor by january 31, 2024. Filing 1099 forms is quick and easy with tax1099.

What Is The Business Process For Form 1099 Rules Compliance For 2023?

To comply with irs 1099 rules for 2023,.

2024 Due Dates For 2023 Year.

1099 forms due in 2024 apply to payments made in the calendar year 2023.

Due To Changes In Reporting Requirements, The 2024 Filings Became A Little More Challenging:

Images References :

Source: www.hourly.io

Source: www.hourly.io

What You Need to Know about Form 1099NEC Hourly, Inc., What is the business process for form 1099 rules compliance for 2023? 1099 forms due in 2024 apply to payments made in the calendar year 2023.

Source: www.taxbandits.com

Source: www.taxbandits.com

Line by Line 1099NEC Instructions How to fill out Form 1099 NEC, What is the business process for form 1099 rules compliance for 2023? For example, if you made payments in 2023, you must file.

Forms 1099 NEC vs 1099 MISC (Differences for 2023) Tipalti, 1099 forms due in 2024 apply to payments made in the calendar year 2023. What is the business process for form 1099 rules compliance for 2023?

Tax Form 1099MISC Instructions How to Fill It Out Tipalti, Copy a must be filed (paper or electronic version) with the irs, and copy b must be sent to the contractor by january 31, 2024. Form 1099 nec deadlines / due dates.

Source: dembojones.com

Source: dembojones.com

1099 Rules For Tax Year 2022 Dembo Jones Certified Public Accountants, Due to changes in reporting requirements, the 2024 filings became a little more challenging: If the deadline falls on any weekend or public holiday, the deadline will move to the next business day.

Source: www.efile4biz.com

Source: www.efile4biz.com

Form 1099NEC Instructions and Tax Reporting Guide, For example, if you made payments in 2023, you must file. Due to changes in reporting requirements, the 2024 filings became a little more challenging:

Source: blog.123paystubs.com

Source: blog.123paystubs.com

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog, If the deadline falls on any weekend or public holiday, the deadline will move to the next business day. Due to changes in reporting requirements, the 2024 filings became a little more challenging:

Source: falconexpenses.com

Source: falconexpenses.com

What is Form 1099NEC for Nonemployee Compensation, Filing 1099 forms is quick and easy with tax1099. What is the business process for form 1099 rules compliance for 2023?

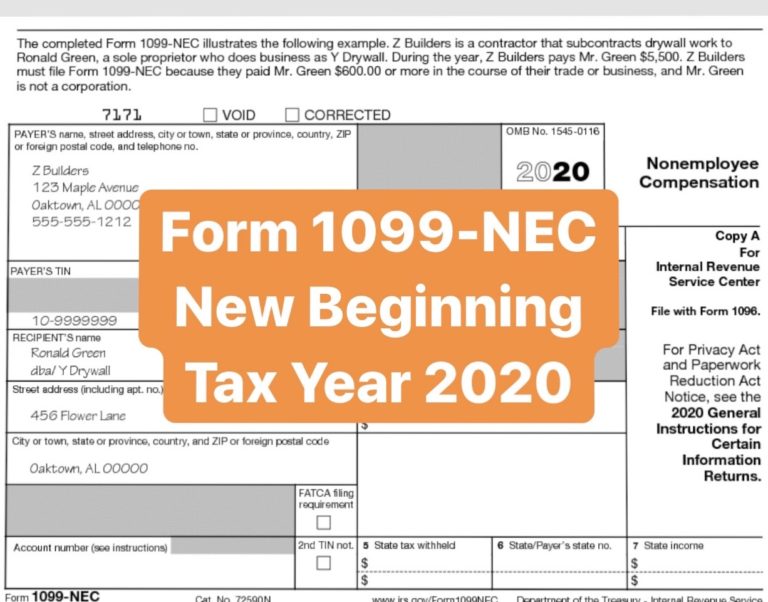

Source: www.bluesummitsupplies.com

Source: www.bluesummitsupplies.com

What is Form 1099NEC for Nonemployee Compensation?, For example, if you made payments in 2023, you must file. Understanding the intricacies of tax forms can be taxing, especially when it comes to navigating the complexities of nonemployee compensation.

Source: flyfin.tax

Source: flyfin.tax

How To Use the IRS 1099NEC Form FlyFin, What is the business process for form 1099 rules compliance for 2023? Understanding the intricacies of tax forms can be taxing, especially when it comes to navigating the complexities of nonemployee compensation.

1099 Forms Due In 2024 Apply To Payments Made In The Calendar Year 2023.

Understanding the intricacies of tax forms can be taxing, especially when it comes to navigating the complexities of nonemployee compensation.

For Example, If You Made Payments In 2023, You Must File.

2024 due dates for 2023 year.