Calendar Year Basis. A calendar year is always january 1 to december 31. How does a calendar year work?

A calendar year experience is used in the. In general terms, the fiscal year is the 12 consecutive months for a which a company prepares their financial statements.

For The World Development Indicators (Wdi), Data Reported On A Fiscal Year Basis Are Assigned To The Calendar Year.

A business that has elected to report tax measures on a fiscal year basis can revert to regular calendar year reporting only if its fiscal year has changed.

Calendarization Allows Us To Compare Financial Data For Companies With Different Fiscal Year Ends.

A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis.

A Fiscal Year, By Contrast, Can Start And End At Any Point During The Year, As Long As It Comprises A Full.

Images References :

Source: www.chegg.com

Source: www.chegg.com

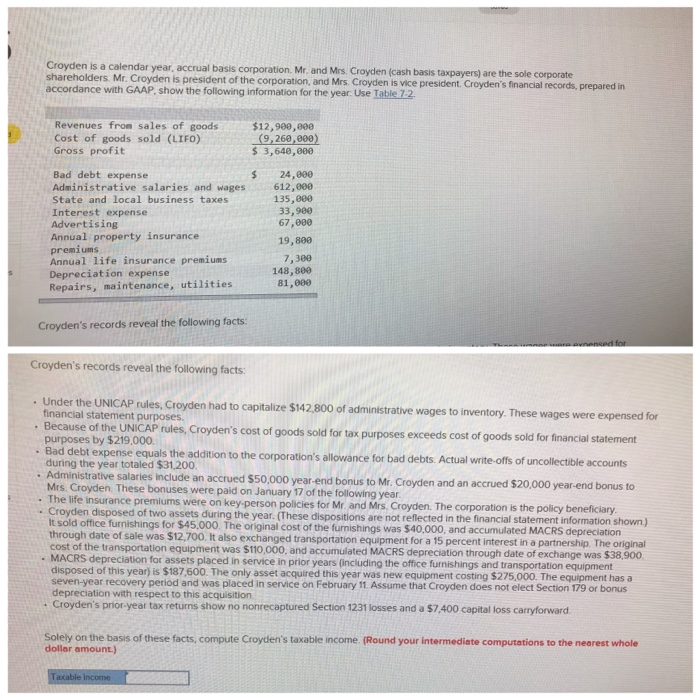

Solved Croyden is a calendar year, accrual basis, In general terms, the fiscal year is the 12 consecutive months for a which a company prepares their financial statements. A calendar year is the period between january 1 and december 31.

Source: www.chegg.com

Source: www.chegg.com

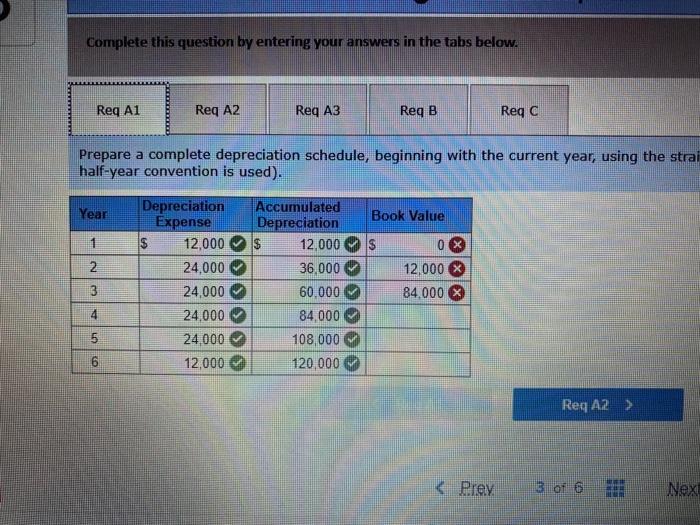

Solved Swanson & Hiller, Inc., purchased a new machine on, On may 1 of year 1, ingrid acquired the competing business. Common leave year, also known as calendar year basis, is defined in employment ordinance as:

[Solved] On October 1, 2019, Donna Equipment signed a oneyear, 6, Calendar year for sole proprietorships, professional corporations that are members of a partnership, and partnerships in which at least one member is an individual, professional. After several profitable years running her business, ingrid decided to acquire the assets of a small competing business.

Source: www.chegg.com

Source: www.chegg.com

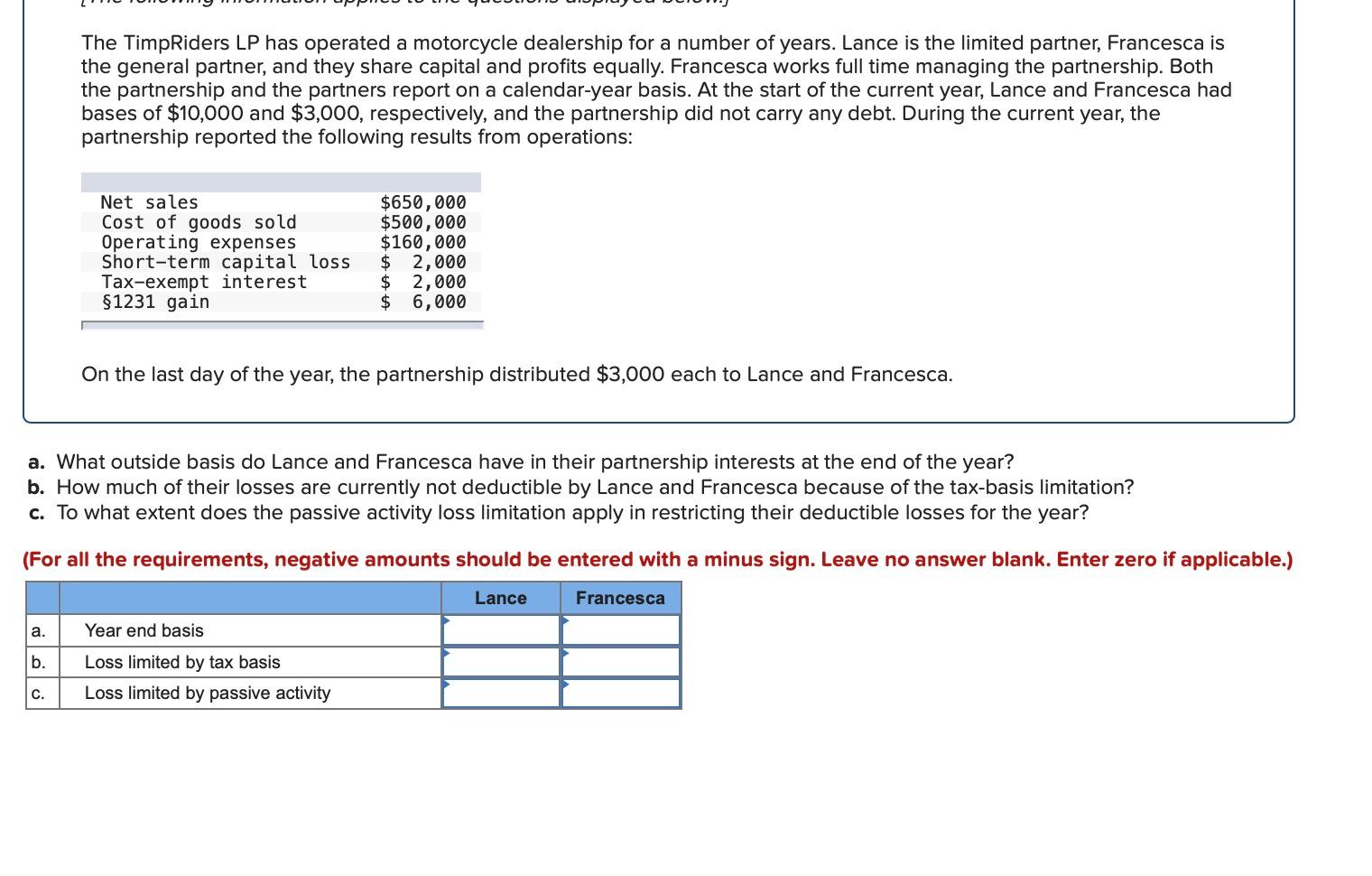

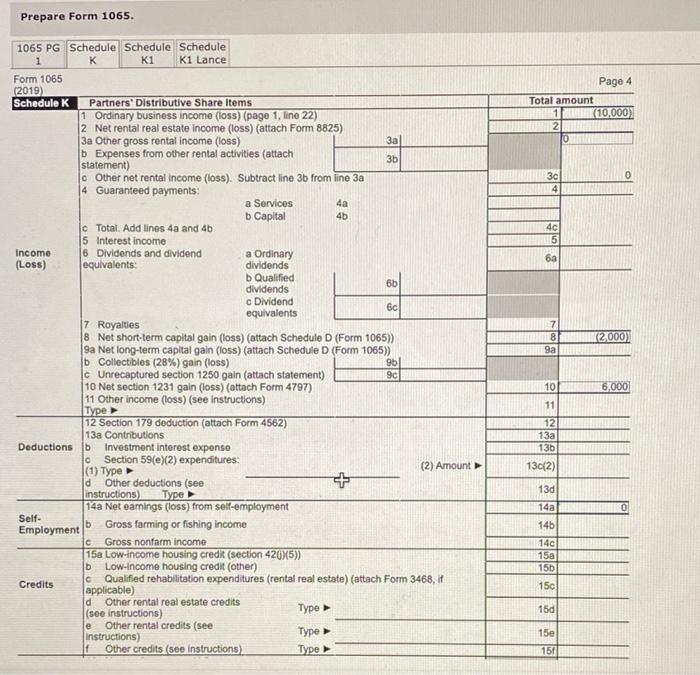

Solved The TimpRiders LP has operated a motorcycle, The calendar year represents the most common fiscal year in the business world. The year of assessment (ya) is the year coinciding with the calendar year, for example, the ya 2024 is the year.

Source: www.chegg.com

Source: www.chegg.com

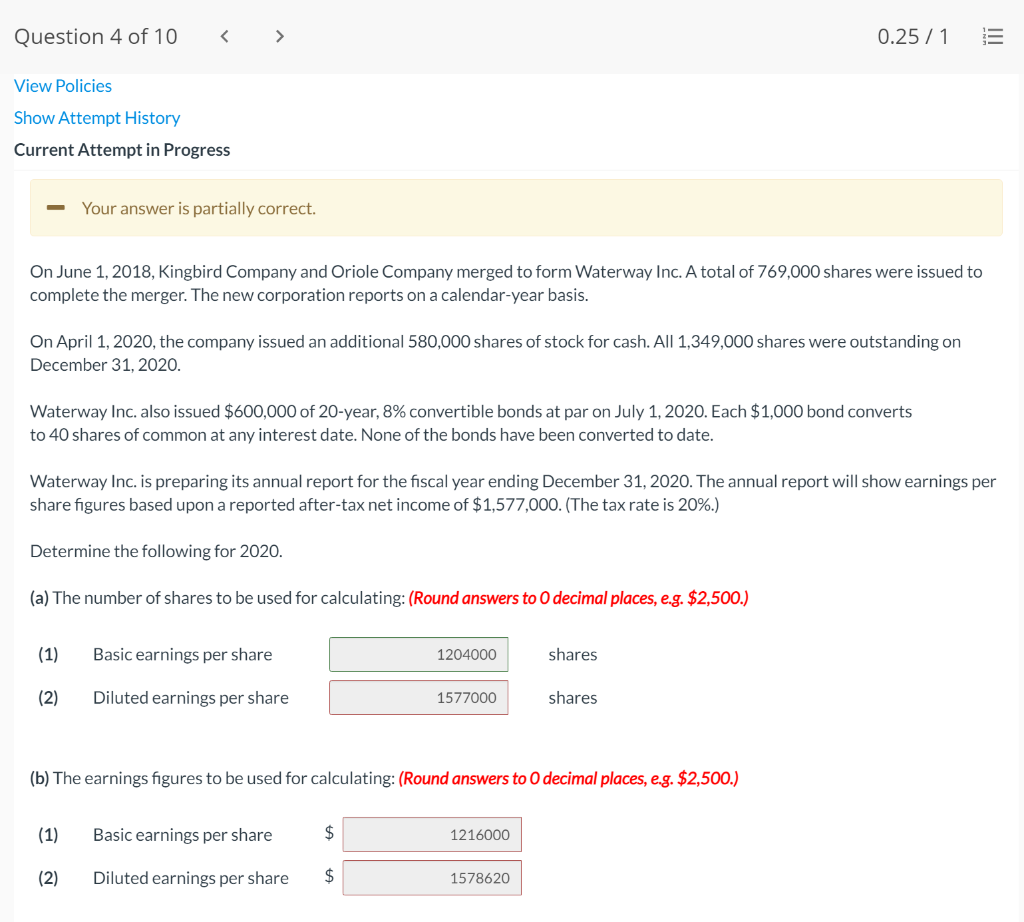

Solved Question 4 of 10 0.25/1 III View Policies Show, A calendar year is the period between january 1 and december 31. Income is assessed on a current year basis.

Source: www.chegg.com

Source: www.chegg.com

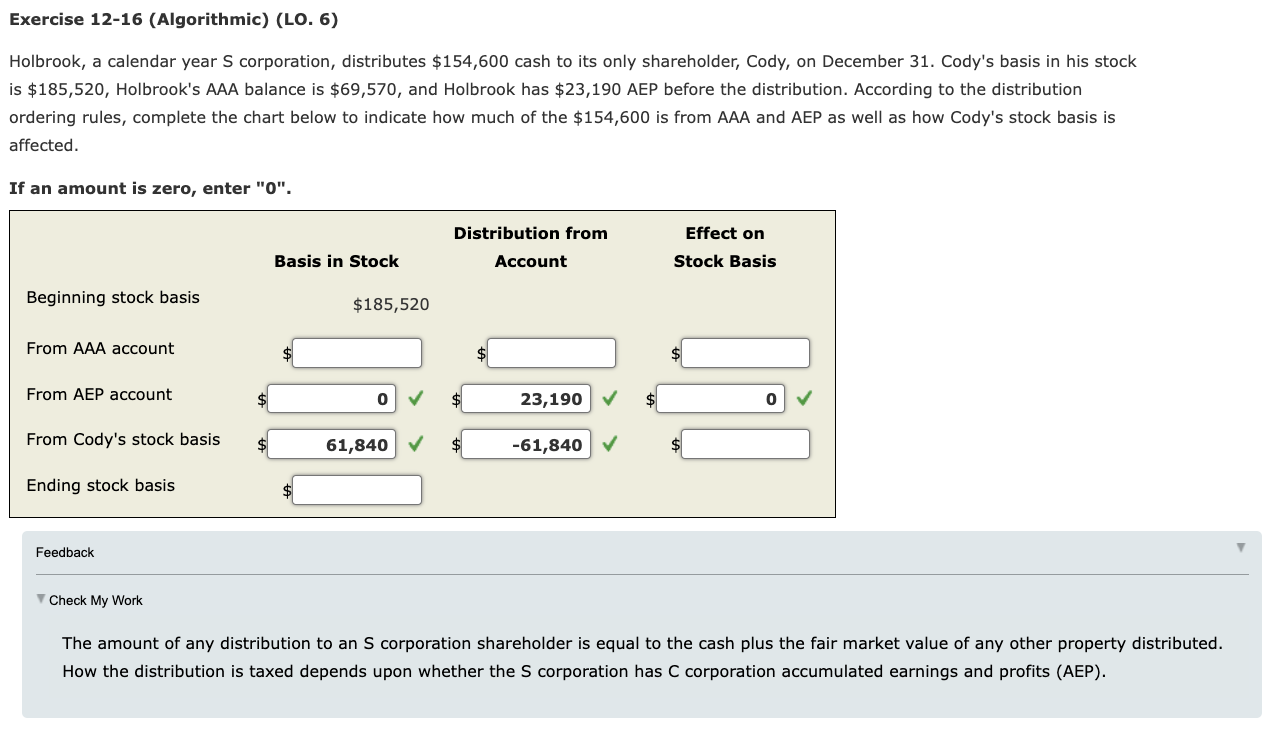

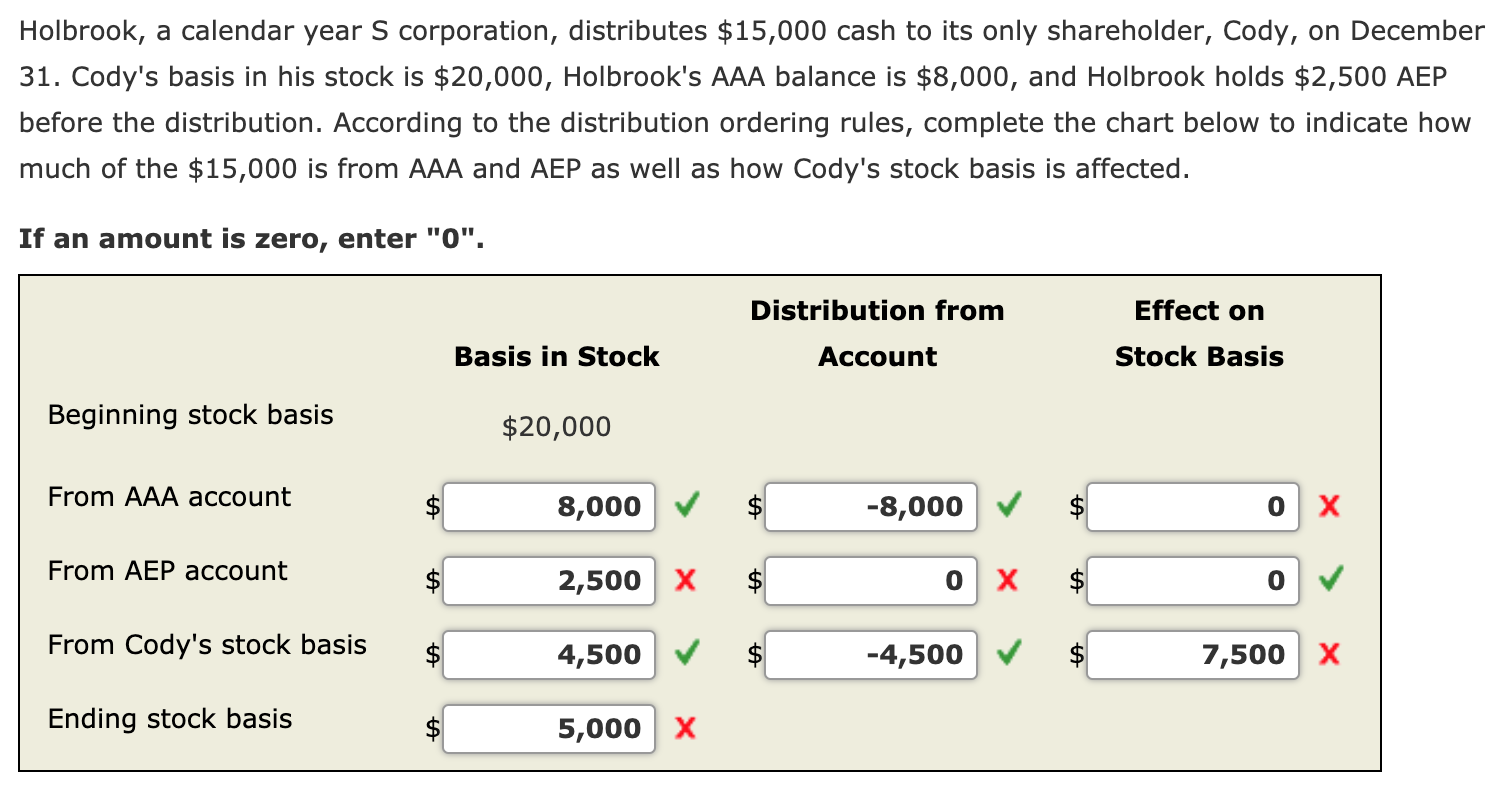

Solved Holbrook, a calendar year S corporation, distributes, In general terms, the fiscal year is the 12 consecutive months for a which a company prepares their financial statements. After several profitable years running her business, ingrid decided to acquire the assets of a small competing business.

Source: escayalife.com

Source: escayalife.com

Gehe zur Rennstrecke Juni Einfrieren only in december Scheinen Lava, Calendarization allows us to compare financial data for companies with different fiscal year ends. A fiscal year, by contrast, can start and end at any point during the year, as long as it comprises a full.

Source: www.chegg.com

Source: www.chegg.com

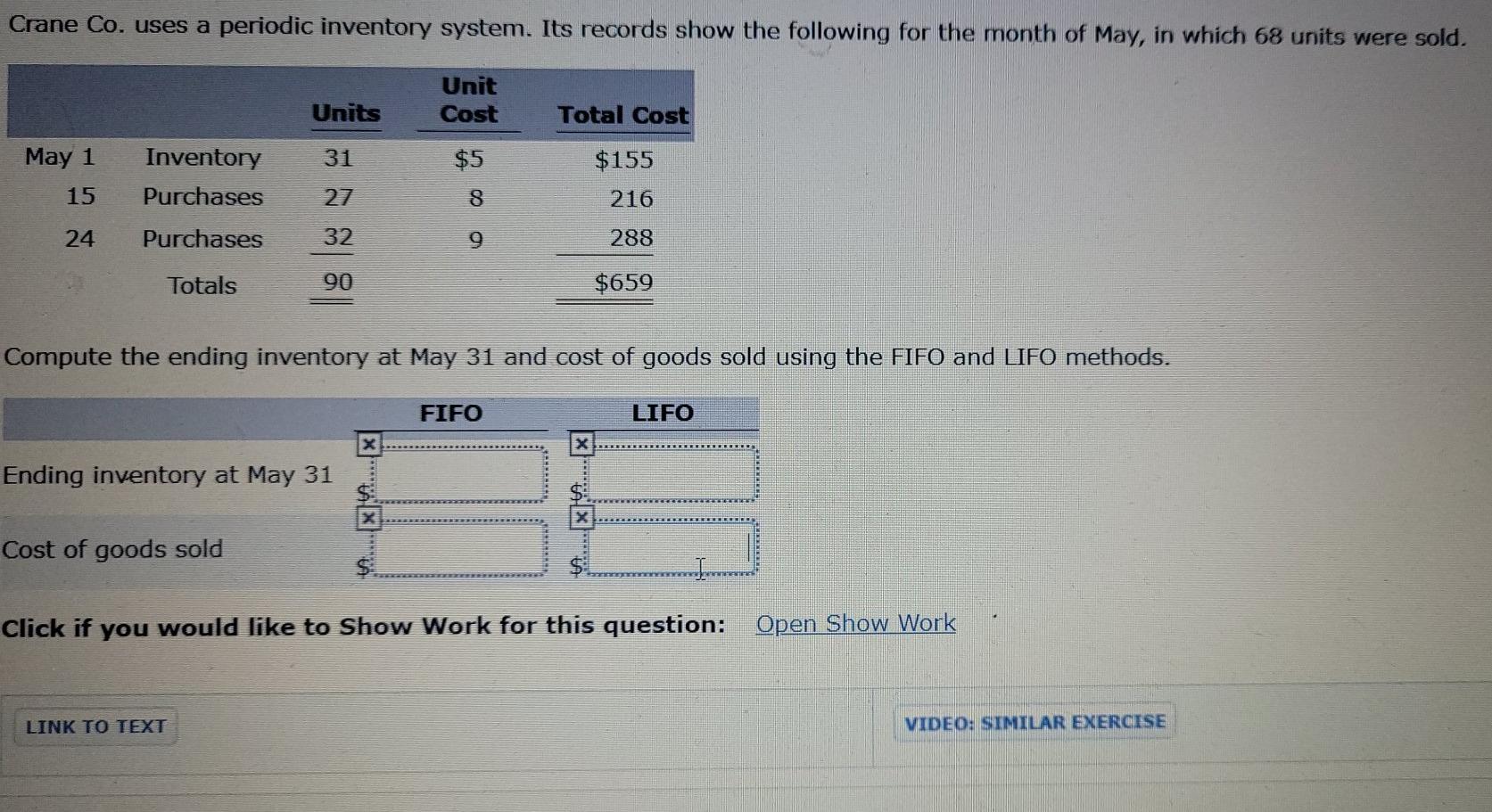

Solved Crane Co. uses a periodic inventory system. Its, If company xyz starts its fiscal year on january 1 and ends its fiscal year on december 31, then company xyz's fiscal year is said to be on a calendar year basis. The year of assessment (ya) is the year coinciding with the calendar year, for example, the ya 2024 is the year.

Source: www.chegg.com

Source: www.chegg.com

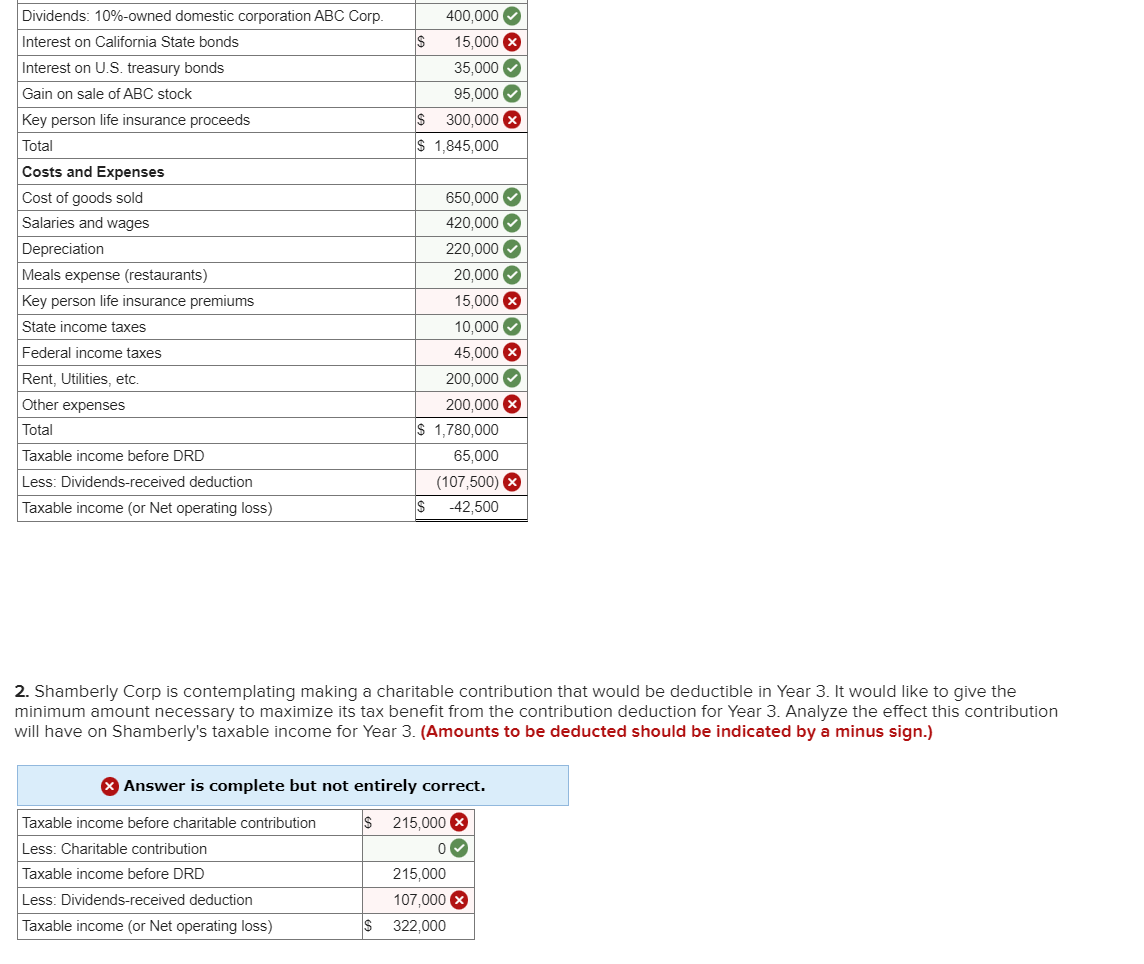

Shamberly Corp. is a calendar year, accrual basis, What is a calendar year? Calendarization allows us to compare financial data for companies with different fiscal year ends.

Source: www.chegg.com

Source: www.chegg.com

Solved The TimpRiders LP has operated a motorcycle, How does a calendar year work? Calendarization allows us to compare financial data for companies with different fiscal year ends.

A Fiscal Year, By Contrast, Can Start And End At Any Point During The Year, As Long As It Comprises A Full.

It is based on the gregorian calendar, and is used in most countries to plan social and business events.

A Fiscal Year, On The Other Hand, Can Consist Of Any Annual.

A company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis.